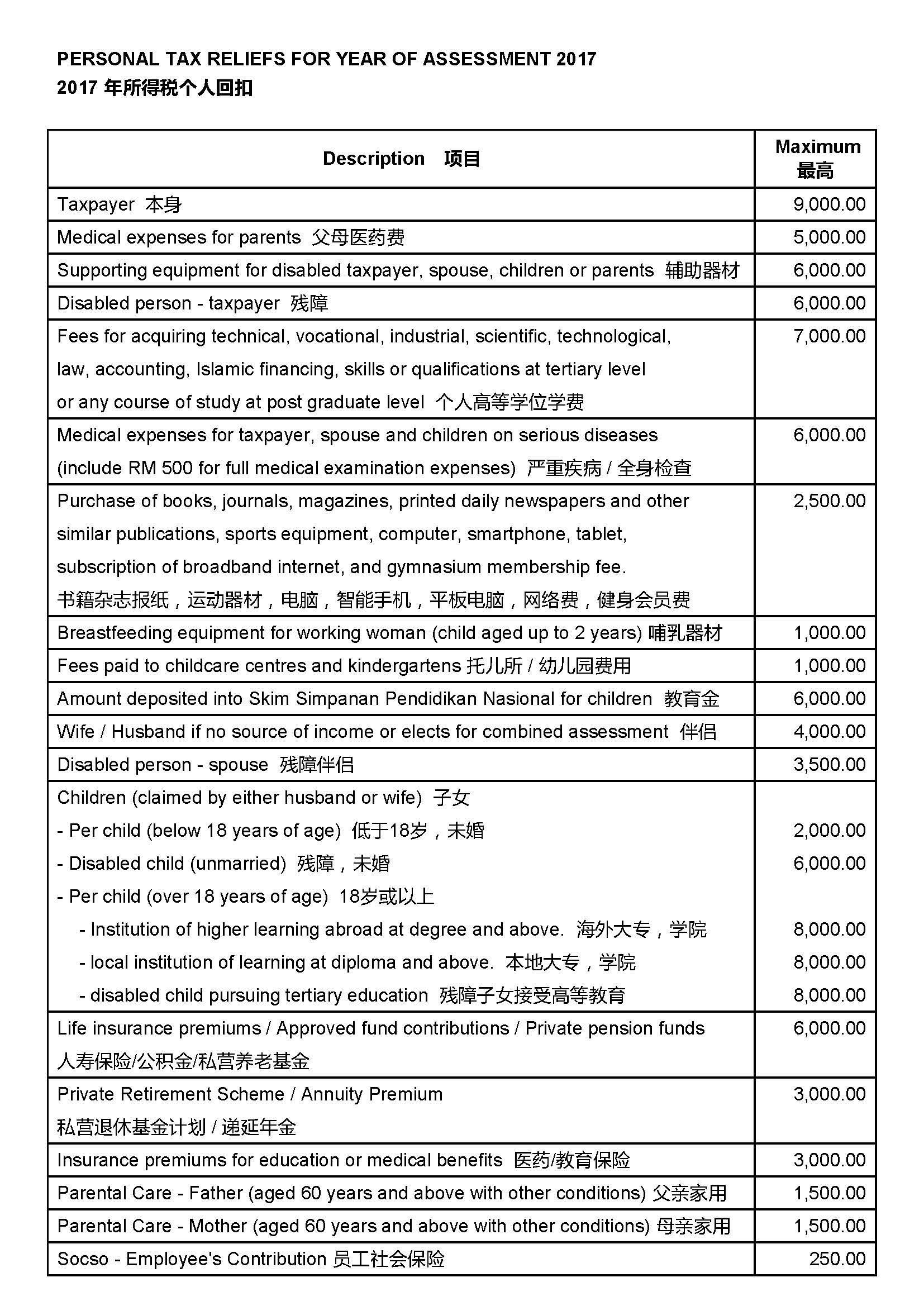

REMARKS : 備註

Parents Medical Expenses 父母醫藥費

Medical treatment for own parents also include expenses to care for parents who suffer from diseases, physical or mental disabilities, evidenced by a medical practitioner certifying that the medical condition of the parent requires medical treatment or special needs e.g. treatment and care at home, day care or home care centres.

父母醫藥費也包括失去自理能力的父母的照料費用(須醫生證明)。

Parental Care 父母家用 (applicable from YA 2016 until 2020)

Conditions to claim parental care :- 父母家用必須符合以下條件。

- Taxpayer does not claim parent’s medical expenses relief. 納稅人沒有扣父母醫藥費;

- Parents are the legitimate natural parents and foster parents. 親生父母和養父養母;

- Parents aged 60 years and above; 60歲或以上;

- Parents are resident in Malaysia in the current year of assessment; 住在馬來西亞;

- Each parent’s annual income does not exceed RM24,000 per annum. 各父母年收入不超過馬幣24千。

Lifestyle 生活方式

- Reading materials excluding banned publication; 閱讀刊物不包括被禁書籍;

- Purchase of sports equipment only for sports activities as defined under the Sports Development Act 1997. 只限有關運動條例列明的運動項目。

Breastfeeding Equipment 哺乳器材

Can be claimed once every 2 years. 每兩年可扣一次。

Childcare and Kindergartens 託兒所和幼兒園

For individual taxpayers who enroll their children up to 6 years of age, in child care centres and kindergartens registered with the Department of Social Welfare or the Ministry of Education.

納稅人的子女(6歲和以下)的託兒所和幼兒園費用,有關託兒所和幼兒園須受社會福利部或教育局承認。